Chandlernews/Wikimedia Commons/CC BY-SA 4.0

Audio By Carbonatix

You know that house for sale down the street? Seems like it’s been on the market for a while, huh?

That’s not just your imagination. Houses in Phoenix are languishing on the market longer than at any time in recent history.

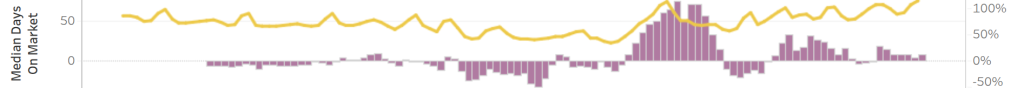

According to data from Realtor.com, houses in the Phoenix-Mesa-Chandler metropolitan area are sitting on the market for a median of 75 days, or roughly two and a half months. That’s a year-over-year increase of 12.8%, one of the highest spikes of any major metro in the country.

The last time homes lingered on the market so long was January 2023, when the median home sat on the market for 74 days. One difference between then and now: Houses were selling for crazy prices in 2023, while the market seems to be softening in Arizona over the last few months.

Those trends hold true at the county and state levels, too. In January, Maricopa County homes for sale sat on the market for a median of 74 days, one more than the previous peak of 73 days in January 2023. The statewide numbers are even more extreme: a median of 77 days on the market, up from 70 a year ago and topping the previous peak of 74 from January 2023.

Realtor.com

This should be encouraging to potential first-time homebuyers looking to secure a home. But is it?

Traditionally, this would signal that homebuyers in Arizona are at an advantage with sellers, who are itching to sell their homes after extended stays on the market.

Other studies indicate as much: A recent study by Refin found that Phoenix is one of the top buyer’s markets in the country, with more homes on the market than buyers. Home prices are also dropping in the state, as Arizona saw the second-highest year-over-year decrease at 3.15%, or an average of $13,745. Nearly all Phoenix homes lost value in 2025, according to a Zillow report.

However, Arizona’s drop in average home prices follows news that Phoenix homeowners delisted their properties en masse this past fall, as homes are no longer selling at the high dollar amounts they were fetching during the pandemic. That means many sellers would rather stand pat than sell at a discounted price. Homeowners also now face significantly higher interest rates than they may be paying on their current property, which is motivating many to hold onto their current home rather than sell it for less than they were asking.

Prices in the Grand Canyon State are still significantly higher than they were pre-pandemic, rising as much as 50% over the last six years, more than the national average. With homebuilding worsened by construction pauses during the COVID-19 pandemic and by high construction costs, there simply haven’t been enough homes to go around. Wages have failed to keep up with rising housing costs, resulting in high eviction and homelessness rates.

To address Arizona’s housing shortage, homebuilding has increased significantly in recent years. But this housing isn’t accessible to many: Most of it is targeted for the rich. Smaller single-family homes, starter homes, condos and affordable family apartments remain few and far between.