Gage Skidmore

Audio By Carbonatix

Arizona State University would like to take Sparky’s trident to Attorney General Mark Brnovich’s tuchis over the AG’s legal objections to the university’s multimillion-dollar real-estate deal with Omni Hotels.

The school is protesting an amended complaint Brnovich filed in state tax court last week – the latest volley in the AG’s ongoing crusade to bring university president Michael Crow’s vaunted “New American University” to heel. ASU released a statement accusing the pugnacious Republican of “cherry-picking” facts about the school’s controversial plan to turn the land it owns at the southeast corner of University Drive and Mill Avenue into a swanky, 30,000-square-foot hotel and conference center.

Contrary to the suit’s latest allegation that ASU is violating the Arizona Constitution’s gift ban with $28 million in sweeteners to Omni, ASU insists the money is in fact an “investment” that would “yield revenue of approximately $140 million for the university.”

What the statement didn’t explain, however, was that this $140 million represents the total revenue realized by ASU over a span of some 62 years, largely deriving from Omni’s initial rent payment of $5.9 million, plus the sum of yearly payments to be made by Omni to ASU that otherwise might be paid in property taxes to local governments.

Nor did ASU’s response reveal that at the end of those 62 years, Omni will have the option to purchase the property for a token $10. ASU also failed to account for what the AG says amounts to an $8.9 million discount in the per square foot valuation of the 1.6-acre property.

In an interview with Phoenix New Times, an ASU spokesman who asked not to be named for this story insisted that the deal was a good one in the eyes of the university. The $140 million, he said, was a “revenue stream” that it can count on for decades.

“We’re operating in a way that we’re trying to get guaranteed income,” the spokesman said, “because we don’t have a funding model from the state.”

Adam Smith Takes Exception

Critics of the deal remain skeptical that ASU is coming out better in the bargain. They point out that ASU will front the full cost of construction for the conference center – $19.5 million – and the university will build a $30 million parking structure with 1,200 spaces, 275 of which will be dedicated for use of the Omni and its guests. Those 275 parking spots are valued at an estimated $8.5 million.

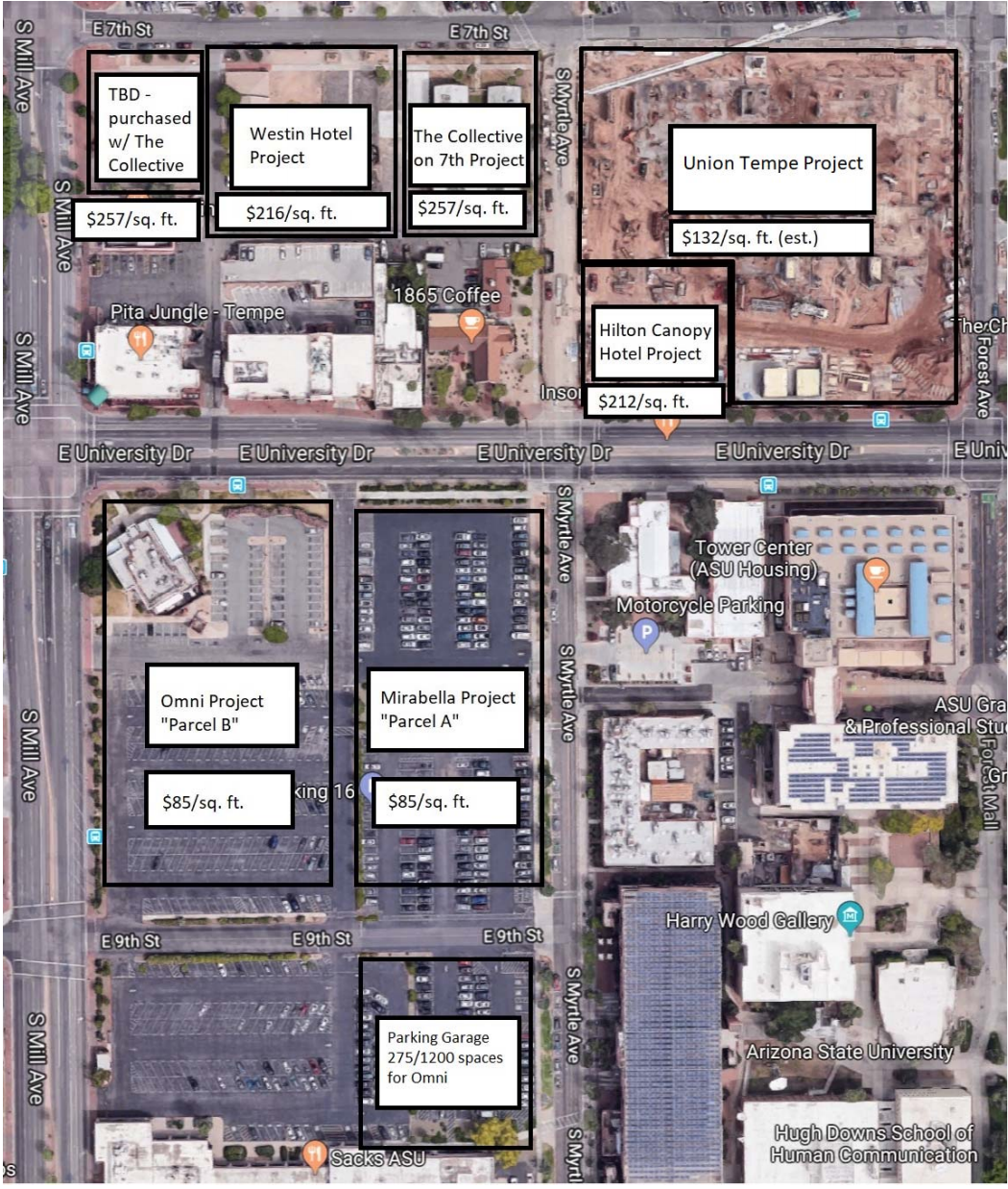

The $19.5 million cost of construction and the $8.5 million in parking spaces equals $28 million. But the AG’s office contends that the Omni deal also undervalues the land on a “golden corner” of downtown Tempe at $85 per square foot, when the going rate should be closer to $212, an $8.9 million windfall for Omni.

ASU’s spokesman said that the university based the $85 per square foot price on two third-party appraisals done in November 2015. The appraisals allowed the university to bypass an Arizona Board of Regents requirement that such land be sold at a public auction.

The AG’s lawsuit cries foul on this point, noting that university officials have contended that ASU is getting “fair market value” for what essentially ends up being a rent-to-own proposition for Omni, despite these same officials stating that ASU would retain ownership of the real estate.

An exhibit from the Arizona Attorney General’s updated complaint on Omni deal, comparing the ASU’s per-square-foot market price to that of neighboring properties.

Arizona Attorney General’s Office

Ryan Anderson, Brnovich’s communication director, described the deal in terms Adam Smith would understand.

“The fact ASU values this property at $85 per square foot goes to show why government should not be involved in real estate transactions,” Anderson told New Times. “ASU gave this property away in order to get a four-star resort there. As to why they did it, or making sense of the economics, I have no idea because it doesn’t make any sense on paper.”

ASU’s spokesman conceded that there might be better investments, but that there were other considerations involved.

“Also important is the creation of an asset that is needed for the mission of the university,” he said. “In this case, an upscale hotel with conference center that can accommodate large events convened by ASU.”

And yet, the AG’s complaint notes that there are five resorts within about five miles of ASU with the same or similar facilities. For example, the 30,000-square- foot Tempe Mission Palms near Fifth Street and Mill Avenue, which offers comparable amenities, is an elegant, four diamond-rated hotel and conference center located a few blocks away from the Omni site.

Of course, “ASU” will be part of the Omni facility’s name, and the university gains free use of the conference center for seven days a year. Otherwise, it must pay to rent out the facility like any other customer. As for the parking garage, ASU planned to build the structure anyway, the ASU spokesman said.

So why Omni? ASU’s spokesman said that the university entertained proposals from three different developers and ended up choosing Omni’s, but there was no official Request for Proposal and no formal bids.

ASU could have sold or leased the land outright. Instead, the university opted for a more complex arrangement, wherein the board of regents holds title to the land on ASU’s behalf and Omni avoids property taxes.

ASU’s spokesman said the arrangement was in the best economic interest of the university. If ASU had sold the property to Omni, it would have received a “one-time, up-front payment of about $6 million,” the spokesman said.

Even if that were the case, Omni would have paid taxes to local governments that it will now avoid. In early 2018, Tempe’s city council voted to forgo $21 million in sales and bed taxes. But the county and the state lose out on property taxes that would have funded community colleges and K-12 schools.

Neither Omni nor the regents returned multiple requests for comments.

Not How the Law Works

Sean McCarthy, a senior research analyst with the Arizona Tax Research Association, a government watchdog group located in Phoenix, told New Times that as part of the Omni deal, the hotel chain will dodge taxes far in excess of the $140 million the university claims it’s getting.

“Our calculations show that their property tax payment would start out at $2.5 to $3 million a year,” he explained. “So right away, it’s a substantial tax break.”

McCarthy said that whether ASU’s $28 million in sweeteners up front is a gift or an investment is less important than the main question at hand: Can ASU and the regents lease their tax-exempt status to Omni?

The Arizona constitution declares that all property is subject to taxation unless it falls under one of several exemptions. These include “federal, state, county and municipal property” and “property of educational, charitable and religious associations or institutions not used or held for profit.”

State statutes allow the regents to lease and sell land, McCarthy observed, as long as it’s for the benefit of the state and the state’s institutions. And on three occasions, the Arizona Legislature has authorized the board to share its tax exemption: specifically for state research parks, special athletic districts, and the University of Arizona’s Medical Center in Tucson.

But according to McCarthy and the AG’s lawsuit, the Legislature has never authorized the kind of leaseback deals that ASU and the regents have been engaging in of late, deals that convey ASU’s tax-exempt status to for-profit corporations for decades at a time.

“What ASU keeps saying is, it’s ASU land, nothing is taxable, nothing to see here,” McCarthy said. “Well, that’s not how the law works, gentlemen.”

McCarthy said that local governments lack the broad power to do what ASU and the regents are doing with Omni and other real-estate deals.

Municipalities can abate taxes on commercial property through a legislature-sanctioned mechanism known as a Government Property Lease Excise Tax (GPLET), but only for eight years at a time.

The Omni deal abates property taxes for more than 60 years.

And in the case of the $928 million State Farm/Marina Heights development – 2.2 million square feet of office space that sits on ASU land overlooking Tempe Town Lake – the tax abatement is for 99 years.

ASU versus Arizona Taxpayers

Tim Lawless, a lobbyist and tax specialist who has worked under both Republican and Democratic governors in developing tax policy, agreed with McCarthy that what ASU and the regents are doing is not sanctioned by the state’s constitution.

“They are substituting their will for the will of the people,” Lawless told New Times in a recent interview.

Lawless explained that Arizona has what’s called a “split” tax roll, with low home property taxes counterbalanced by commercial property taxes that are on average 1.8 times higher than residential property taxes. Arizona’s commercial property taxes are some of the highest in the nation, Lawless said, creating an incredible incentive for developers to seek out abatements.

Which is why tax breaks such as GPLETs are so popular and controversial.

“Usually the rationale for an abatement is that you’re in a slum and blighted area,” he said. “That’s the whole premise for tax increment financing that started in California in the 1960s.”

The practice grew and now abatements are handed out by municipalities like candy, often to keep an office building from being built elsewhere. But at least in the case of local governments, abatements are approved by elected officials. There is no such accountability for the board of regents or the universities.

When ASU leases its tax-exempt status to a business, all state taxpayers lose, Lawless said, because money that should go to K-12 schools is diverted to the university’s coffers, and the state legislature picks up the slack, backfilling the loss of revenue to the schools.

The practice is not only unconstitutional, according to Lawless, it is blatantly unfair to the businesses that do not benefit. Also, if ASU and the regents have this power unto themselves to collect taxes, what’s to prevent community colleges and K-12 school districts from doing the same thing?

Lawless believes that the AG’s suit will be successful, but he suggested a compromise whereby ASU and ABOR be allowed to lease their tax-free status for eight-year periods of time, making it a university equivalent of a GPLET. It’s an idea that would have to be sanctioned by the legislature.

“It’s not the AG’s job to negotiate an outcome,” Lawles said. “It’s up to ASU and [the regents] to come forward and say what they could live with.”

The Omni suit is one of two legal actions that Brnovich is pursuing against ASU and the regents; the other is a 2017 complaint that the university system’s tuition rate runs afoul of the state constitution’s dictate that a university education remain “as nearly free as possible” to Arizona residents.

A superior court judge shot down the tuition suit in 2018, saying the AG lacked standing to bring it. But the AG is appealing and has asked the Arizona Supreme Court to intervene.

Brnovich’s two suits have earned him powerful enemies among Arizona’s movers and shakers – many of whom have a financial stake in ASU and do not care if the university is bending the rules or the law.

But the AG, who won re-election last year in spite of millions of dollars negative campaign ads paid for by California billionaire Tom Steyer, is unlikely to back down. In a press release on his latest action against ASU, he tweaked the university, reminding it of its constitutional obligations.

“ASU is providing a mega hotel corporation with valuable property and amenities at a rate that is nearly free as possible,” Brnovich said. “But those are not the people the Arizona constitution seeks to protect.”