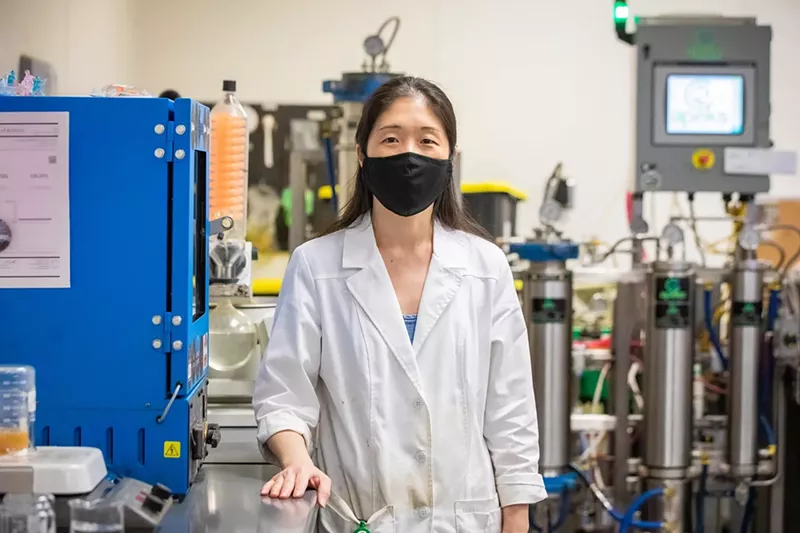

At Giving Tree Dispensary earlier this week, surrounded by jars of viscous, amber cannabis concentrate worth thousands of dollars, lab manager Katarina Park explained that when she was hired six years ago, there was no recipe book to follow.

Back then, Arizona dispensaries that could make tasty and potent edibles, dab-worthy shatter, or hash oil for vape cartridges guarded their secrets carefully. So Park, formerly a senior research chemist for a university, hit the books, studying various methods of making concentrates that could live up to the ethics of Giving Tree's owners, who wanted the dispensary to be known for a high standard of quality.

These days, Park has a potent brand of concentrated marijuana named after her called Katatonic.

"It was not my idea," she said of the moniker, laughing behind her face mask.

A second Giving Tree brand that focuses on edibles, Kindred, has proven even more popular and is now sold in dozens of Arizona dispensaries.

As consolidation in Arizona's marijuana industry has accelerated following the legalization of recreational marijuana last November, brands like Kindred and Katatonic offer a path to success for smaller operators like The Giving Tree, which has a license for only one retail location.

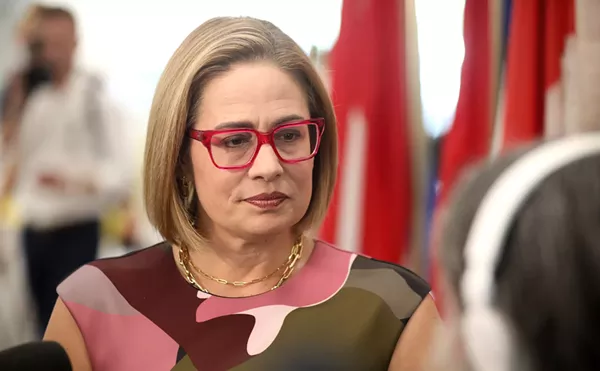

"Our way to expand and grow is through brands," said Lilach Mazor Power, the dispensary's founder and managing director. Last month, to jumpstart that growth, Giving Tree opened a new retail location at 701 West Union Hills Drive and is turning its old location into an expanded cultivation and manufacturing facility.

It's a solid plan, though one that happens to be shared by many other dispensaries. Not only is local competition getting hotter in Arizona, but a new surge of out-of-state businesses is rushing into the state, looking to take advantage of the massive growth expected in Arizona's post-legalization cannabis industry. Some are expecting to see current sales triple or even quadruple. They're partnering with Arizona dispensaries, moving into manufacturing facilities, and ramping up production as fast as they can.

Some of the companies behind these brands are creating manufacturing centers similar to the way Kalil Bottling Company in Arizona makes and distributes Dr. Pepper and other franchised sodas, said Demitri Downing, founder of the Marijuana Industry Trade Association of Arizona (MITA).

"All kinds of brands across the country are looking at Arizona," Downing said. "The consumers are going to be demanding them."

Ramping Up

Either recreational or medicinal marijuana is now legal to some extent in 47 states, but much of the cannabis market is new and remains a capitalistic frontier.Since medical marijuana became legal a decade ago, Arizona consumers have seen the rise of many brands that have become household names: Select, Baked Bros, and Timeless. But there's nothing like a national brand yet.

"I don't think we know yet who will be the Coca Cola in this industry," said Jason Vedadi, who resigned as executive chair of Harvest last year and is now the CEO of Oasis Cannabis.

Big companies and "mom and pops" see Arizona as a way to gain market share and create new relationships with other industry players, Vedadi said. Brands are taking on new importance everywhere in the industry as it matures, he said.

But plenty of challenges exist for brands looking to get their products to consumers.

The biggest obstacle to brand consistency is that marijuana remains federally illegal. That means plant material can't be transported across state lines to Arizona. Everything else can be moved here, though: key employees, patents and trademarks, recipes, quality-control procedures, manufacturing equipment, packaging, etc.

Newcomers who don't have the estimated $15 million to buy someone else's dispensary license must contract with an existing dispensary in order to legally grow, possess, and process commercial quantities of cannabis.

In these deals, contract terms are negotiated between the dispensary and would-be brand partner, and may hinge on which partner has more power and resources.

For instance, an established, multi-state brand can muscle into Arizona and possibly set the terms with small- or medium-sized dispensary companies, who may find it difficult to say no when their customers want the product. In that case, a non-Arizona brand might be able to demand specific shelf prominence, pricing, or other factors. Conversely, a smaller brand that wants to get into a large, multi-state Arizona dispensary company like Curaleaf may have to make compromises.

"Someone who is well-funded is going to kill it," Downing said.

The state's new recreational licenses allow existing medical marijuana businesses to develop additional cultivation or processing facilities, as Giving Tree is doing. There's no limit on the number of businesses that can contract to use a dispensary's facility. Several new "incubator" facilities are popping up around town that will host the production and cultivation operations of multiple brands, each of which would be sold in dispensaries around the state.

Jeff Schaeffer, founder of Parc Dispensary (now Local Joint), just closed on an 84,000-square-foot cultivation, extraction, and kitchen facility. He said he's not ready to divulge the location. He's planning to bring in 12 to 20 different brands from other states that will lease the space to grow and make their products, plus buy basic supplies from his company, including flower and distillate, that they need to make their products.

If anyone can make something like this work, it's Schaeffer. In addition to running Parc for six years, which included designing and setting up a new grow facility, Schaeffer has worked as the director for MITA, been a partner of the SWCC Expo, consulted for cannabis companies, and helped found a sports-oriented CBD business. He has partnered with another dispensary to make his incubator plan work, but he won't divulge that, either. The facility and its future tenants will compete "somewhat" against products that Schaeffer still has a financial interest in, but Arizona has "plenty of room to grow," he said. He plans to facilitate wholesale sales of the vendors' wares to other dispensaries.

"There's a definite need for [more] flower, which is why we're building such a large facility," he said. "There's not a lot of national brands at all in the state right now."

In fact, demand in Arizona has overwhelmed product supply since recreational sales began in late January. Some dispensaries were caught off guard by the earlier-than-expected licensing and didn't have their supplies or packaging ready, said Kim Prince of Proven Media, a local cannabis-company public relations firm.

Dispensaries need more products in general, and customers often ask for brands that can't yet be found in Arizona. Bringing in new brands is good for business and creates excitement — even if it dilutes interest in local brands.

High Hopes

Christine Smith of Portland, Oregon, is excited to have Arizona cannabis consumers try what she believes are the perfect, low-dose edibles. She's the CEO and founder of Grön, which makes THC-infused gummies and chocolates. The idea behind the brand is to appeal to consumers who prefer high-quality edibles. The products are made "using only hand-harvested, Fair Trade cacao beans" and ingredients that are "organic, local, and sustainably sourced whenever possible," according to the company's website.Its premier products are "Pearls," the brand name for its spherical, sugar-coated gummy balls. Grön started up in 2015 and has become one of the biggest brands in Oregon. It's in 85 percent of Oregon dispensaries and also sold in other states, she said. Smith said the business grew from 51 employees to 75 just in the last two weeks to help with the Arizona launch. (They're still hiring.)

Moving into Arizona has been another "fun and challenging" stage of her self-funded company. She's partnered with a local company — she declined to name it — to provide the raw cannabis material for the Arizona products and planned to distribute them at various Arizona dispensaries starting this week. Some days are more challenging than others. Gron was ready to launch at Bloom and Territory dispensaries on Monday, but as of Thursday she still had no product to deliver because her dispensary partner didn't sign off on an internal inspection as expected.

"I have no words to describe my frustration," she said on Wednesday. "We have over $1 million of inventory ready to go out the door... I'm told this isn't unusual in Arizona." She added that "every new market has its own challenges."

For Clint Pyatt, CEO of Country Cannabis of Oklahoma, the goal is to become the "Budweiser" of weed. His brand can now be found in 70 percent of Oklahoma dispensaries and is being sold in several states.

Pyatt's currently in negotiations to partner with a major Arizona brand. Like Schaeffer and Smith, Pyatt wasn't ready to say who that partner was to avoid any chance that a better-resourced brand might try to shove him aside and try to make the partner a better deal.

Yet Pyatt downplayed the challenges he's faced, saying the expansion plan so far seems to be moving ahead smoothly. Consistency and ensuring an adequate supply of product have been the biggest concerns in the Arizona move, he said. He intends for his company to help alleviate both problems.

"Our whole mindset is that we're going to get ahead of this whole curve," Pyatt said. "Our marketing, our branding — everything — is geared toward that rationale. It's like Hershey's chocolate ... you go to one state and you have that consistency."

Country Cannabis is experienced at cultivation, according to Pyatt, and knows how to keep the marijuana consistent across the states. He and the group he plans to partner with are similarly "ahead by years" in cultivation science, perfecting growing conditions and plant genetics, he said. A final deal is "on the one-yard line" now.

"We're ready to do it," he said.